Difference between revisions of "Setup Menu (QuickBooks)"

(→Bill Presentment) |

(→Bill Presentment) |

||

| Line 144: | Line 144: | ||

Subject: The subject the customer will see when a bill presentment email is sent. | Subject: The subject the customer will see when a bill presentment email is sent. | ||

| − | Custom Text: Enter the text that will appear when a bill presentment email is sent. | + | |

| + | Custom Text: Enter the text that will appear when a bill presentment email is sent. Custom text cannot exceed 500 characters | ||

| + | |||

Company Logo: Click Load Logo to upload an image that will appear on the statement when a bill presentment is sent. | Company Logo: Click Load Logo to upload an image that will appear on the statement when a bill presentment is sent. | ||

| + | |||

PDF Preview: Click to view a sample bill presentment statement. | PDF Preview: Click to view a sample bill presentment statement. | ||

Revision as of 12:55, 17 April 2017

PLEASE NOTE: Only the admin user of the company file should access the Setup menu. Accessing Setup while logged in as a non admin user has the abiltiy to remove required information.

Account Info

Software License Key/ Phone Number/ Company ID: To register the payment application on an account, you will need to provide the software license key, phone number, and company ID. Each of these values are included in your activation email.

View Tutorial - Click to view QuickSale™ for QuickBooks Help Site.

Start Wizard - A streamlined approach to the Setup Menu.

Features - Offers advanced options and tools.

Server Location: Displays the location of the database file (db4.mdb) that is currently being utizilized by the payment application.

Trans Options

Automatically synchronize the encrypted database upon adding/modifying QuickBooks Customers:

- If selected, Payment application will prompt to synchronize the encrypted database after a customer profile has been modified.

Automatically request to process payment upon saving Receive Payment/Sales Receipt: (Intuit Emulation)

- If selected, a prompt to process payment will appear the first time you save a Receive Payment/Sales Receipt. (Please note, you will be prompted after every receive payment/sales receipt regardless of payment type. Also, if payment is not approved, that receive payment/sales receipt will need to be deleted or voided manually.)

Allow Duplicate Transactions:

- If unselected, payment application will block the second transaction on one card for the same amount within a batch.

Card Present:

- If selected, the card present field will be automatically checked in all of the payment application windows.

Do Not Import Transactions from Gateway: Selected by default.

- If unselected, you will be able to import transactions run from different devices on the same account to create payment records within QuickBooks.

Import Returns/Voids: You can select what time frame the payment application will search for payments in QuickBooks to adjust upon importing returns/voids being.

Automatic Import:

- If selected, you will be able to set up a timed import of transactions run from different devices on the same account to create payment records within QuickBooks, You can select to receive notifications upon completion of import or if import failed.

Sales Tax: You can choose to have the payment application calculate sales tax on all your sales. You can also select to run all your transactions as tax exempt.

Clerk ID:

- Rep - Transactions will be associated with the rep assigned to the customer's profile.

- Workstation - Assign a unique ID to a workstation to identify which computer processed the transaction. (For multiuser licenses)

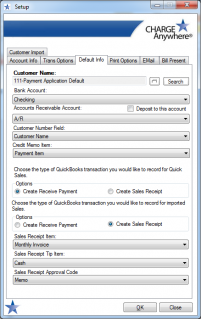

Default Info

Customer Name (required): 111-Payment Application Default is a customer created by the payment application and is the recommended default customer. The default customer is used for import error handling.

Bank Account (required): Select a bank account. If you select deposit to this account, a deposit will be made to the selected bank account after every payment created by payment application. Otherwise, payments will be applied to undeposited funds.

Accounts Receivable Account (required): Select an accounts receivable.

Customer Number Field: The selected item will be sent to the gateway as the customer identity.

Choose the type of QuickBooks transaction you would like to record for QuickSales: Choose whether a payment or sales receipt will be created after processing a sale. (If sales receipt is selected, Sales Receipt Item will become a required field.)

Choose the type of QuickBooks transaction you would like to record for imported sales: Choose whether a payment or sales receipt will be created after importing a sale. (If sales receipt is selected, then Sales Receipt Item will become a required field.)

Credit Memo Item (required): Select an item that will populate the credit memo created by the application upon processing or importing a return.

Sales Receipt Item: Select an item that will populate the sales receipt created upon processing or importing a sale.

Sales Receipt Approval Code: Approval code and last four digits of the card can be stored in the memo of the sales receipt or on a new line.

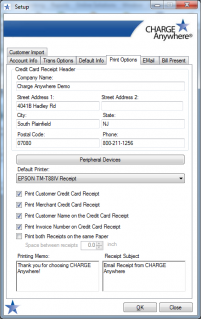

Print Options

Credit Card Receipt Header: You can edit the header that will appear on receipts.

Peripheral Devices: You can select a compatible swiper, contactless reader, printer, pinpad, and/or signature capture device to work with the payment application.

Default Printer: Select a Windows printer for receipts.

Printing Memo: You can customize text for the receipt trailer.

Receipt Subject: You can customize the subject title when receipts are emailed.

Bill presentments and Receipt Emails require Email setup.

Default Settings

Merchant Email: The email address that is entered into this field will be displayed as the ‘from’ address when receipts or bill presentments are sent to customers

Merchant Name: This will be displayed as the business name when receipts or bill presentments are sent to customers.

Custom Settings

Custom settings can be used when you have you own server for emailing. To use custom settings, you will need to know your SMTP port, SMTP Server, SMTP Username, and Password.

Bill Presentment

- Bill Presentment is an add-on service. Only merchants with active bill presentment services will be able to view this tab. Contact your merchant service provider to activate the service. If the bill presentment service was activated after registration, you will need to unregsiter and reregister your account to access this tab.

Invoice Configuration

Select the fields you would like to appear in the bill presentment invoice: Quantity, Item Code, Amount, Price Each, Invoice#, Account#, Date, Due Date, Terms, Rep, Ship, VIA, F.O.B., Project, PO Number, Other.

Email Configuration:

Subject: The subject the customer will see when a bill presentment email is sent.

Custom Text: Enter the text that will appear when a bill presentment email is sent. Custom text cannot exceed 500 characters

Company Logo: Click Load Logo to upload an image that will appear on the invoice when a bill presentment is sent.

PDF Preview: Click to view a sample bill presentment invoice.

Statement Configuration

Email Configuration:

Subject: The subject the customer will see when a bill presentment email is sent.

Custom Text: Enter the text that will appear when a bill presentment email is sent. Custom text cannot exceed 500 characters

Company Logo: Click Load Logo to upload an image that will appear on the statement when a bill presentment is sent.

PDF Preview: Click to view a sample bill presentment statement.

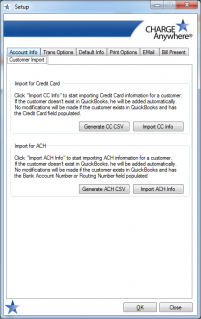

Customer Import

Customer Import will allow you to create a spreadsheet of customers and payment information and import them into the payment application database and QuickBooks customer database. (Please note: any customer on the spreadsheet that already has payment information stored in the QuickBooks customer profile will be skipped.)