Search Transactions

Search Transactions stores all your transactions for 2 years. Transaction records older than 2 years are available upon request. You can double click a transaction record for more details and options. Use the tabs at the top of the page to view transaction records for different tender types: Credit Card, ACH, Prepaid / Gift Card, Cash and Check. Use the search criteria to expand or narrow the search results.

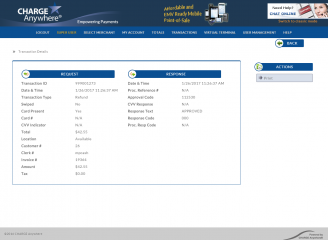

Credit Card Transaction Details

Double click a transaction to access the transaction details. The field descriptions are listed below.

Gateway Ref #: An automatically assigned unique transaction number

Transaction ID: An automatically assigned transaction number

Date: Date and time transaction was sent to the processor

Batch #: CHARGE Anywhere batches all transactions automatically on a daily basis and sends it to your processor for funding.

Transaction Type: Sale, Void, Return, Force. Retry, Auth Only, Auth Only Reversal or Reversal

Pin Transaction: Displays Yes if a PIN number was processed during debit transactions.

Recurring: Displays Yes if the transaction was processed via the recurring database

Input Type: Displays Manual if keyed, Swiped, Contactless if processed with a contactless reader, or Chip if processed with an EMV reader

Track Number: Displays the track of the credit card used during a swiped transaction

Card Present: Displays Yes if swiped or selected during keyed transactions

Card Type: Displays the credit card brand

Card #: Displays the first and last four digits of the credit card

Full Name: Displays the name on the card of a swiped transaction

Exp Date: Expiration date of the credit card (MMYY)

Street Address: Billing address of the credit card (Numerical values are the qualifier)

Zip Code: Billing zip code of the credit card

CVV Indicator: Displays whether the CVV was entered or bypassed

Grand Total: Total amount sent for approval

Cash Back: Amount given to the customer in cash during PIN debit transactions included as a part of the Grand Total

Orig. Trans. ID, Trans Type, Grand Total, Approval Code: Used when forcing (capturing) a previous auth only transaction

Purchase Level, Purchase Code, Tax Exempt: Level 2 and 3 cards are government or business issued credit cards that require a purchase code in order to receive an approval. Level 2 and 3 cards may be tax exempt.

Location: Displays the GPS coordinates for transactions originating from mobile devices with location services turned on.

Date & Time: Date and time of the processor's response

Reference #: The processor's transaction identification

Approval Code: Six character code associated with approved transactions

AVS Result: Describes whether the street address and zip code matches what the issuing bank has on file

CVV Result: Describes whether the CVV matches what the issuing bank has on file

Response Text & Response Code: Displays the result of the transaction. See Transaction Responses for more info.

Processor Response Code: Response codes unique to each processor

Auth Amount: The amount authorized by the processor

Settle Amount: The amount sent to your processor for funding

Transaction options are located at the top of the transaction details screen. The transaction options vary depending on the type of transaction, the processor, and the amount of time elapsed.

Void: A transaction can only be voided if the batch has not yet been closed (generally the same day of the transaction). Voiding a transaction will remove the transaction from the batch. Depending on the processor and the bank, a hold may remain on the customer's card for a few business days before the hold is released.

Return: A return will initiate a credit to a customer's credit card. Once return is selected, you will be prompted to enter the amount that will be returned.

Capture: You can only force a previous Auth Only transaction. A force will claim the pending authorization so that it may be batched for funding.

Reversal: A transaction can only be reversed if the batch has not yet been closed (generally the same day of the transaction). Reversing a transaction will remove the transaction from the batch and remove the hold from the customer's card.

Partial Reversal: A transaction can only be reversed if the batch has not yet been closed (generally the same day of the transaction). Partially reversing a transaction will lower the settlement amount of the transaction and remove part of the hold from the customer's card. Once partial reversal is selected, enter the amount you want to reverse and the final settle amount will display the funds you will receive for the transaction.

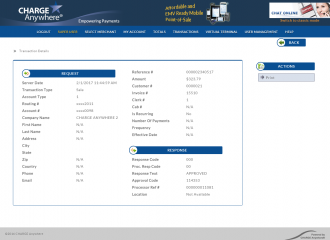

ACH Transaction Details

Double click a transaction to access the transaction details. The field descriptions are listed below.

Server Date: Date and time transaction was sent to the processor

Transaction Type: Debit, Credit or Void

Account Type: Personal Checking, Personal Savings or Business Checking

Routing # and Account #: Customer's banking information

Company Name, First Name, Last Name: Authorized signer of the bank account

City, State, Zip, Country, Phone, Email: Bank account profile information

Response Code & Response Text: Displays the result of the transaction

Proc. Resp. Code: Response codes unique to each processor

Processor Ref: The processor's transaction identification

Location: Displays the GPS coordinates for transactions originating from mobile devices with location services turned on

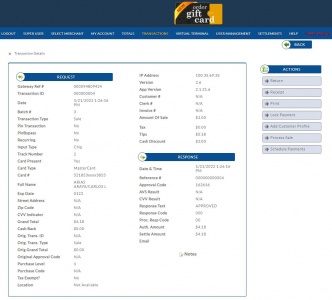

Prepaid / Gift Card Transaction Details

Double click a transaction to access the transaction details. The field descriptions are listed below.

Transaction ID: An automatically assigned transaction number

Date & Time: Date and time transaction was sent to the processor

Transaction Type: Charge, Refund, Activate, Add Value, Deactivate or Balance Inquiry

Swiped: Displays No if keyed

Card Present:Displays Yes if swiped or selected during keyed transactions

Card #: First and last four digits of the card processed

CVV Indicator:Displays whether the CVV was entered or bypassed

Total: Total amount sent for approval

Location: Displays the GPS coordinates for transactions originating from mobile devices with location services turned on.

Date & Time: Date and time of the processor's response

Proc. Reference #: Date and time of the processor's response

CVV Response: Describes whether the CVV matches what the issuing bank has on file

Response Code & Response Text: Displays the result of the transaction

Proc. Resp. Code: Response codes unique to each processor

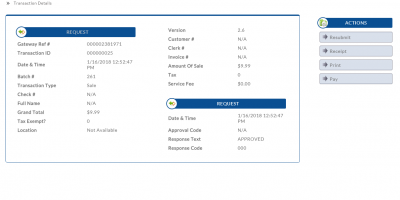

Cash Transaction Details

Double click a transaction to access the transaction details. The field descriptions are listed below.

Gateway Ref #: An automatically assigned unique transaction number

Transaction ID: An automatically assigned transaction number

Date & Time: Date and time transaction was sent to the processor

Transaction Type: Sale or Refund

Check #: Checks processed from the mobile are classified as Cash transactions in Transaction Manager and identified by the Check #.

Full Name: Name of customer

Grand Total: Total amount received

Tax Exempt: Displays Yes if customer is exempt from taxes

Location: Displays the GPS coordinates for transactions originating from mobile devices with location services turned on.