Difference between revisions of "CHARGE Anywhere Designed for Use with QuickBooks"

(→Common Quickbooks Error Handeling) |

(→Common Quickbooks Error Handeling) |

||

| Line 382: | Line 382: | ||

[http://kb.chargeanywhere.com/index.php/Pending_Transactions Unable to Create Payment in QuickBooks] | [http://kb.chargeanywhere.com/index.php/Pending_Transactions Unable to Create Payment in QuickBooks] | ||

| + | |||

| + | [http://kb.chargeanywhere.com/index.php/Pending_Transactions Unable to Create Payment in QuickBooks] | ||

| + | |||

| + | [http://kb.chargeanywhere.com/index.php/Review_Pending_Transactions There are pending transaction(s) Do you wish to review them?] | ||

Revision as of 07:42, 2 March 2017

Overview

QuickSale™ for QuickBooks is an integrated payment app for QuickBooks Financial versions Pro, Premier, and Enterprise 2008 and higher. Once installed, CHARGE Anywhere will reside within the Company Menu of your QuickBooks Company File and offers a variety of ways to process and maintain your payments.

System Requirements: Windows Vista (minimum); Microsoft .Net Franework 2.0 (minimum)

Supported Peripherals: Peripheral Help

Features: Free Online Transaction Manager & Virtual Terminal, Recurring Database, Import Transactions, AVS & CVV2, Clerk # & Invoice #, Level 1 and Level 2 Purchase Cards

Add on Features: Bill Presentment; Signature Capture Hosting

*A Credit Card Merchant Account is required to process credit card payments. CHARGE Anywhere does not provide Merchant Accounts but is compatible with all major Payment Processors in the US & Canada.

Getting Started

QS for QB Installation - Download and install QuickSale™ for QuickBooks

- QS for QB Reinstallation - For those reinstalling QuickSale™ for QuickBooks

Application Certificate - Grant CHARGE Anywhere permission to QuickBooks

QS for QB Setup Wizard - Configure the payment application to fit your business

Peripheral Help - Get help configuring cardreaders, pinpads, signature capture devices, etc

Processing Transactions

QuickSale™ for Quickbooks offers a variety of ways to collect payments. Choose the method that fits you best.

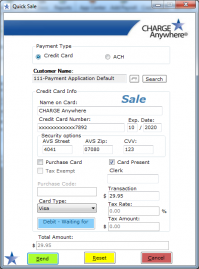

QuickSale - True to its name.. a quick way to process a sale!

Process Payment - Process a sale, multiple sales, voids or returns. (recommended)

Intuit Emulation - More comfortable with Intuit's method of processing a sale? We can do that too!

Recurring Transactions - Schedule your payments ahead of time.

Bill Presentment - Send customers an email and let them pay you!

- Also Relevant - Transaction Responses

CHARGE Anywhere Menu Options

QuickSale

There are three ways a QuickSale can be initiated.

QuickSale from Invoice/Sales Receipt - Pull transaction data from an invoice or sales receipt. Upon approval, a payment will be applied to the current invoice or the sales receipt will be updated with the approval code.

QuickSale without Invoice/Sales Reciept - Search for a customer to run a sale. Upon approval, a payment or sales receipt will be created for the selected customer.

QuickSale from Swipe (not recommended) - Initate a sale by swiping a card through a compatible card reader. A customer will be created in QuickBooks with the same name as the track data on the credit card. Upon approval, a payment or sales reciept will be created and applied to the new customer.

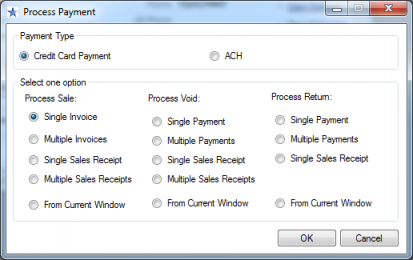

Process Payment

You may process both Credit Card and ACH transactions through Process Payment.

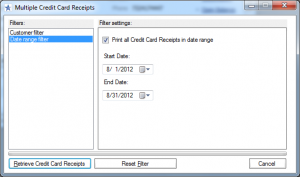

Print Receipt

To print or email prior credit card receipts:

1. Go to Company > CHARGE Anywhere > Print Receipt.

2. Search for receipts using the customer filter and/or date range filter. Click Retrieve Credit Card Receipts.

3. Select the receipt(s) you wish to print or email. Emails will be sent to the email address listed in the QuickBooks customer profile.

Import Transactions

Import Transactions is a feature used to search for all transactions on your gateway account that was not processed by the payment application and automatically create the payment records within QuickBooks. This feature is recommended when utilizing the Transaction Manager, QuickSale™ for Mobile App, and any other device on your gateway account.

*To import, Do Not Import must be not be selected from the Trans Options tab of Setup.

*Imported sales will create payments or create sales receipts based on the selected option in the Default Info tab of Setup.

1. Go to Company > CHARGE Anywhere > Import Transactions.

2. Select a date range to view transactions processed within that timeframe.

3. Select the transactions you wish to import and click Import Transactions.

4. A dialogue screen will appear with the import results.

*Imported sales will be applied to the invoice# or customer# entered in the original transaction. If no invoice or customer matches in QuickBooks, the payment will be applied to the default customer.

*Voids can only be imported if the original sale transaction was created by the payment application in QuickBooks.

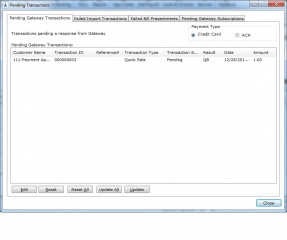

Pending Transactions

Pending Transactions stores transactions that have not finalized. Transactions with Pending Status occur when payment records have not been created. Otherwise, the payment application has not gotten a proper response from the gateway, possibly due to lack of internet connection or firewalls.

Pending Gateway Transactions - Transactions initiated from QuickBooks, but have not created payment records or have not reached the gateway for authorization.

Failed Import Transactions - Imported transactions that have failed to create payment records within QuickBooks

Failed Bill Presentments - Bill Presentments that have not been sent properly

Pending Gateway Subscriptions - Recurring Transaction that failed to be created

Bill Presentment

Email invoices or statements to your customer that includes a link to a secured site so that the customer may enter their own payment information.

- Bill Presentment is an add-on service. Contact your merchant service provider to activate the service.

- Email settings must be configured in order to use the Bill Presentment feature.

1. Go to Company > CHARGE Anywhere > Bill Presentment.

2. Select Single Invoice, Single Statement or Multiple Invoices.

3.Type Invoice #, Statement # or search for multiple invoices and confirm that you would like to send bill presentment.

4.Verify the bill presentment details and press OK. (The fields can be automatically populated with by configuring Bill Presentment tab in the Setup menu.)

5. A dialog screen will appear. It will ask if you would like to preview the bill presentment and display the results of the bill presentment.

Once the customer has processed payment, transactions can be imported to create payment records within QuickBooks. See Import Transactions

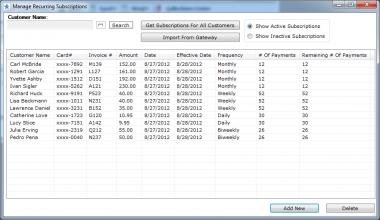

Recurring Transactions

Initiate a set number of sale transactions to be automatically processed against a customer's account within a scheduled time frame. All approved sales can be imported to create payment records within QuickBooks.

Recurring Transactions - Add New

Recurring Transactions - Edit Subscription

Import From Gateway: Click to sync the payment application database with the Transaction Manager Recurring Database and import transactions,

Active/Inactive Subscriptions: Toggle between active and inactive subscriptions.

Reports

Credit Card Expiration Date Range allows you to search for all credit cards saved in the payment application database that will expire within a selected timeframe.

Transaction Manager

Click to have your default browser open to the Transaction Manager log in page. Log in to view account activity, export transaction history, and process transactions via Virtual Terminal.

The username for Transaction Manager is included in your activation email. The password is sent in a seperate email for security purposes.

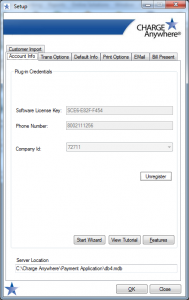

Setup

Click link above for a closer look at all Setup has to offer.

PLEASE NOTE: Only the admin user of the company file should enter the Setup menu. Accessing Setup while logged in as a non admin user has the abiltiy to remove required information.

Account Info - Registration info and advanced features

Trans Options - Adjustable transactions options geared to fit your method of processing

Default Info - Required components for the payment application

Print Options - Receipt options and peripheral configurations

Email - Required to email receipts and bill presentments

Bill Presentment - Adjustable options for the Bill Presentment view (Bill Presentment tab will only be visible if bill presentment is active on your gateway account)

Customer Import - Import customer profiles and payment information

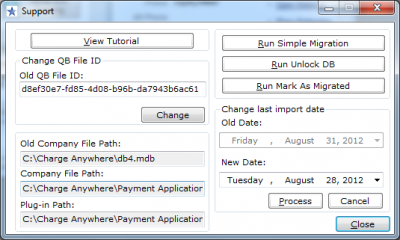

Support

View Tutorial - Click to browse QuickSale™ for QuickBooks Help Site.

Change QB File ID - Change QB File ID will reset the payment application database and should only be used as a last resort to troubleshooting. All credit card information and payment history will be deleted from the payment application's database.

Plug In Path - Displays the current and previous locations of the payment application database, (db4.mdb). Simple Migration allows you to change this path.

Run Simple Migration - Simple Migration is a tool that allows you to select the database that will be accessed by the payment application.

Run Unlock DB - Unlocks various forms to allow them to be processed against.

Run Mark as Migrated - Bypasses conversion from antiquated versions.

Last Import Date - Automatic imports will only import transactions processed after selected date.

About CHARGE Anywhere

This will display the version of your software.

Latest Version available: 2.1.1.3

QB Integration

QB Integration indicates that transactions processed with other applications on your gateway account will be imported to create payment records in QuickBooks. If you are using invoices to record sales in QuickBooks, follow the Invoice Method for QB Integration. Otherwise, follow the Sales Receipt Method.

Invoice Method

- Ensure that Create Receive Payment is selected for "Choose the type of QuickBooks transaction you would like to record for imported sales" in Default Info of the Setup menu.

- Include an Invoice# or Customer# when processing every non-QuickBooks transaction for proper assignment during import.

*To create payment records in QuickBooks, follow steps for Importing Transactions

Result A: If Invoice# was included in the original sale, a payment will be created and applied to that invoice.

Result B: If Invoice# is not found in QuickBooks or Invoice# was not included in transaction, the payment will be created for the Customer# included in the original transaction.

Result C: If neither the Invoice# nor Customer# is found in QuickBooks, payment will be created and applied to the Default Customer. (Payments can be moved from the Default Customer after import)

Sales Receipt Method

- Ensure that Create Sales Receipt is selected for "Choose the type of QuickBooks transaction you would like to record for imported sales" in Default Info of the Setup menu.

- Choose a Sales Receipt Item and Sales Receipt Tip Item in Default Info of the Setup Menu. Any sales receipt created upon import will include the Sales Receipt Item selected priced at the amount of the sale.

- Include a Customer# when processing every non-QuickBooks transaction for proper assignment during import. (If you would like to assign a Sales Receipt #, include it as the Invoice# in the original transaction.)

*To create Sales Receipts in QuickBooks, follow steps for Importing Transactions

Result A: If Customer# was included in transaction, a Sales Receipt will be created for that customer.

Result B: If Customer# is not found in QuickBooks, a Sales Receipt will be created for the Default Customer. (Sales Receipts can be moved from the Default Customer after import)

Result C: If Invoice# was included in original transaction, the created Sales Receipt will be assigned that #. (If that Sales Receipt# already exists in QuickBooks, a new Sales Receipt will NOT be created. The existing Sales Receipt will be updated with the transaction's approval code.)

The Customer# included in a transaction can be assigned to the matching Customer Name, Company Name or Account Number in QuickBooks. When using the Sales Receipt Method, some people choose to use the Account Number as the Customer# to avoid typung lengthy names when processing transactions.

Log into QuickBooks as admin user. Go to Company > CHARGE Anywhere > Setup > Default Info. Set the Customer Number Field to Customer Name, Company Name or Account Number.

Demos and FAQs

Demos - Click link to view demo videos

Q: Is QuickSale™ for QuickBooks PCI compliant?

A: Yes. All of CHARGE Anywhere payment applications are driven by our Level 1 PCI validated payment gateway, ComsGate. We maintain the highest levels of PCI standards and best practices to ensure cardholder data is kept safe from misuse and identify theft. Utilizing the services of Compliance Point, the industry leader in CISP/PCI compliance, CHARGE Anywhere undergoes a continuous, rigorous audit process to confirm that our products and services are compliant with the latest Card Association regulations.

Q: Can QuickSale™ for QuickBooks work with my processor?

A: Yes. QuickSale™ for QuickBooks can work with any major processor in the US and Canada. Visit our corporate site for a complete list of processors that are compatible with QuickSale™ for QuickBooks.

| Chase Payments | Elavon (Nova) | Euro 6000 | Euronet | Evertec | FDMS Atlanta | FDMS Omaha | FDMS Nashvillle | FDMS Nashvillle CAN | FDMS Rapid Connect* |

|---|---|---|---|---|---|---|---|---|---|

| FDMS South LAC | FDMS South Mexico | FDMS South US | Global Payments | Heartland | JetPay | Merchant eSolutions | Moneris (Canada) | Moneris (USA) | NIBSS |

| Nucleus | Paypal | Redeban | TPS/EVO | TSYS (Vital)* | VISA ACP | Cross Check | First ACH | Global eTelecom | TeleDraft |

| Transmodus |

* Processor is certified for EMV transactions

Q: What are the costs associated with QuickSale™ for QuickBooks?

A: All fees are designated by your merchant service provider. Please contact your merchant service provider for a price quote.

Q: Do I have to turn off Intuit Merchant Services before using QuickSale™ for QuickBooks?

A: No, QuickSale™ for QuickBooks does not interfere with any other processing software you are currently using. However, if you are utilizing a card reader, it may not be able to work properly with two merchant services simultaneously.

Q: How do I turn off Intuit merchant services in QuickBooks.

A: You will have to contact Intuit to cancel your account.

Q: How do I batch my transactions?

A: CHARGE Anywhere is a host capture gateway. All approved transactions are automatically batched by CHARGE Anywhere and sent to your processor for funding. There is nothing you will need to do to initiate the batch.

Q: How do I change my automated batch time?

A: You can contact your merchant service provider or CHARGE Anywhere Customer Support to change your batch time. Batches can be set to automatically close on any hour of the day.

Q: What peripherals can I use with QuickSale™ for QuickBooks? (card readers and pinpads)

A: For a complete list of peripherals, see Peripheral Help.

Q: Are my transactions accessible online?

A: Yes. All transactions are stored in the online Transaction Manager for 24 months. After 24 months, all records are archived and can be retrieved upon request.

Q: What kind of customer support does QuickSale™ for QuickBooks offer?

A: CHARGE Anywhere Customer Support and Technical Support are available Monday through Friday from 9am to 7pm ET.

Common Quickbooks Error Handeling

CHARGE Anywhere is not showing up in the Company Menu

Unable to Create Payment in QuickBooks

Unable to Create Payment in QuickBooks

There are pending transaction(s) Do you wish to review them?